Family Protection Trusts (FPTs)

If you transferred assets (house, cash, bonds) to an FPT, you are no longer the owner; the Trustees jointly hold the legal title.

This does NOT mean they can do what they wish with the assets. It does mean that even if you are one of the Trustees you cannot on your own deal with the assets. It’s important to note that Trustees who are not beneficiaries as defined in the trust deed are not entitled to any share in the trust assets. Don’t worry that you have signed over a share of the eventual sale proceeds of your house to the McClures names – you have not.

Trustees must agree on such things as whether and when to sell a house, how to invest the sale proceeds and how to distribute the assets amongst beneficiaries on winding up the Trust. Where there is no consensus majority rule may apply in Scotland, but all must agree in England/Wales unless the Trust Deed contains a specific provision to that effect.

The Trustees hold the legal title to the Trust assets in Trust for the beneficiaries subject to their powers and duties set out in the Trust Deed and the common/statute law of Scotland or England/Wales as appropriate.

What’s the difference between a Scottish Trust and an English Trust?

The wording of the trust deed is significantly different because the Trust uses and reflects the common/statute law of wherever your main residence is. The fact that you used a Scottish-based solicitor’s firm is not pertinent so long as they adhered to, and applied, the relevant law to your Trust.

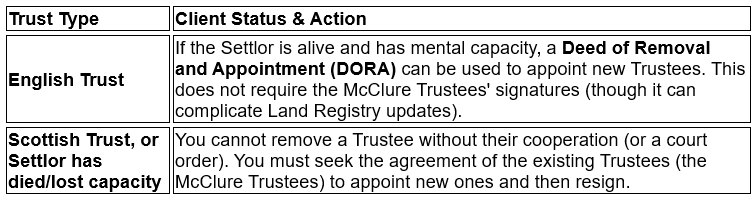

One significant difference concerns the ability to remove and appoint Trustees. The English Trust Deeds give specific powers to the Settlor whilst the Scottish Trusts do not. Another difference is that the English Trusts Deeds identify the property transferred to the Trust on its creation. The Scottish Trusts we have seen leave this to be dealt with in a separate Deed.

You will likely need professional help to remove and replace the McClure / Jones Whyte Trustees.

Note on Fees: The McClure/Jones Whyte Trustees may demand a fee and an indemnity (protection from future claims) in exchange for their cooperation and signatures on a Deed of Assumption and Resignation (DOAR). Be prepared for this and consult with your solicitor.

Glossary of Terms

We try to avoid using too much jargon but unfortunately some is unavoidable. The following explanations should help.

Trust – A Trust is like a protective box that you place assets in. You do not then technically own the assets. They are held by the Trust for the benefit of the people named in the Trust, which includes you.

Settlor – This is the person who gives assets to the Trust (i.e. you). The Settlor has control over the Trustees and therefore, in practice, over the Trust itself. In Scotland this person is sometimes referred to as the “Truster”.

Trustees – These are the people that the Settlor appoints to manage the Trust and to follow the rules of the Trust.

Trust Deed/Trust Document – this is, in effect, the rule book relating to the Trust. It will be signed by the Settlor and then the Trustees will be duty bound to follow its instructions. It will usually ensure the right of the Settlor to continue to live in any property passed into the Trust and that any assets are passed to the relevant people when the Trust ends.

Executors – These are the people that you appoint in your Will to wind up your estate. Their job is made a lot easier if you have already passed your assets to the Trust as they have less to distribute. Executors have no power to deal with assets in the Trust.

Probate (Grant of Probate) – When you die owning assets of significant value (usually sums over £5,000) your executors (see above) have to gain the court’s authority before they can distribute them. This comes in the form of the Grant of Probate.

Power of Attorney (Scotland) or Lasting Power of Attorney (England/Wales) – This is a separate legal document allowing you to appoint people, called Attorneys, to manage your financial and/or welfare affairs should you become unable to do this yourself. All powers of attorney cease on the death of the donor. They are not relevant to dealing with assets in the trust or the donor’s estate outside the trust.